Loans

A loan is money you borrow and must pay back with interest. Student loans can come from the federal government, from private sources such as a bank or financial institution, or from other organizations. Learn the basics and manage your federal student loan debt.

To apply for a federal student loan, you must first complete and submit a Free Application for Federal Student Aid (FAFSA) form. Based on the results of your FAFSA form, Ridgewater College will send you a financial aid offer, which may include federal student loans. Ridgewater College Financial Aid advisors will tell you how to accept all or a part of the loan.

- General Loan Information

-

For general loan information refer to theFederal Student Aid Department an office of the U.S. Department of Education.

You will find information about current interest rates, loan limits, federal requirements for student loan programs, and much more.

After you apply for your loans, the money will be credited to your account if you are enrolled and still attending classes; if not the loan money will be returned to the U.S. Department of Education.

- Federal Direct Loans

-

An eligible borrower is a student enrolled in a post-secondary program on at least a half-time basis. The school will determine the borrower status as either a dependent or independent student.

If you intend to apply for a Federal Loan, read the three-step process [PDF] you’ll need to complete. Part of this process includes completing your Entrance Counseling and Master Promissory Note.

Loan Origination Fees

There are origination fees taken from your loan disbursement before it is disbursed to you.

For all loans where the first disbursement is made on or after Oct. 1, 2020, and before Oct. 1, 2026, the loan fees are as follows:

• 1.057% for Direct Subsidized Loans and for Direct Unsubsidized Loans. As an example, the loan fee on a $5,500 loan would be $58.13.• 4.228% for Direct PLUS Loans (for both parent borrowers and graduate and professional student borrowers). As an example, the loan fee on a $10,000 loan would be $422.80.

For more information about Origination Fees: https://studentaid.gov/help-center/answers/article/what-is-origination-fee

Undergraduate Students Interest Rates:

Effective July 1, 2024 – 6.53%

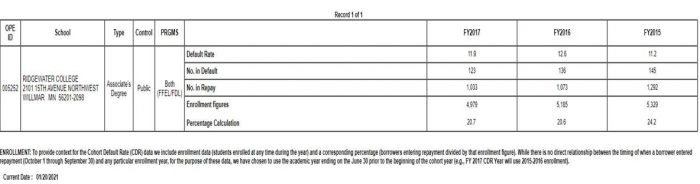

Effective July 1, 2025 – 6.39%Ridgewater Colleges 3 Year Cohort Default Rate

Loan Limits

Subsidized/Unsubsidized

1st year $3,500/$2,000

2nd year $4,500/$2,000As an independent student, you may be eligible to borrow up to an additional $4,000 in an unsubsidized loan.

Interest Responsibility

Subsidized: Federal government pays the interest while a student is in school (at least half time) when a loan is in the grace period (first 6 months after you leave school) and during a period of deferment (a postponement of loan payments).

Unsubsidized: Borrower is responsible for all interest costs. Interest may be paid quarterly, annually, or capitalized (applied to principal) during period of enrollment.

Standard Repayment

Payments begin six months after student withdraws, graduates, or drops below half-time status. Minimum monthly payment is $50. The loan must be repaid within 10 years. Extended, graduated, or income-sensitive repayment options are available.

Consolidating Your Federal Student Loans

There are lots of reasons borrowers should consolidate their student loans. Unfortunately, the process of consolidating is sometimes more complicated than the decision to consolidate. As a result, some borrowers consolidate without taking full advantage of the benefits of consolidation, while others decide not to consolidate at all.

- Find information on consolidation from Federal Student Aid.

- Minnesota Self Loans and private loans cannot be consolidated.

- Find all of your federal loans at www.studentaid.gov. After you log in you will see them on the dashboard in the My Aid section.

- Federal PLUS Loan

-

An eligible borrower is a parent of a dependent student enrolled in a post-secondary program on at least a half-time basis. The school determines PLUS Loan eligibility. Borrower credit review required.

Loan Origination Fees

There are origination fees taken from your loan disbursement before it is disbursed to you.

For all loans where the first disbursement is made on or after Oct. 1, 2020, and before Oct. 1, 2026, the loan fees are as follows:

• 1.057% for Direct Subsidized Loans and for Direct Unsubsidized Loans. As an example, the loan fee on a $5,500 loan would be $58.13.• 4.228% for Direct PLUS Loans (for both parent borrowers and graduate and professional student borrowers). As an example, the loan fee on a $10,000 loan would be $422.80.

For more information about Origination Fees: https://studentaid.gov/help-center/answers/article/what-is-origination-fee

Parent PLUS Loan Interest Rates:

Effective July 1, 2024 – 9.08%

Effective July 1, 2025 – 8.94%Loan Limit

No annual maximum. Parent may borrow up to full cost of student’s education less any other financial aid the student receives.

Interest Responsibility

Borrower is responsible for all interest costs.

Standard Repayment

Payments begin 30 to 60 days after full loan disbursement. (An In-School Deferment can be requested each year while the student is still attending, up to a maximum of four years.) Minimum monthly payment is $50. Loan must be repaid in 10 years.

The parent borrower will need to know their FSA ID to apply.

To apply please go to the Federal Student Aid website.

- Private Loans

-

Ridgewater College recognizes that not all students will be able to meet the financial requirements of paying for an education on their own, even with the assistance of traditional financial aid resources. We cannot recommend a loan program or lender for you; however, we can provide you with the information you will need to borrow wisely.

Each borrower’s wants and needs are unique. You should evaluate each loan program to determine the best loan for you and your educational plans.

Do not borrow more than you can afford to repay.

Tips on Private Loans

Do your homework before submitting an application. Interest rates are usually determined by the applicant’s and/or co-signer’s credit history or score. Be sure you ask what your interest rate is going to be, and if there are any upfront fees or fees added later when repayment starts. Be sure you also know the consequences of withdrawing from school early, making a late interest payment or making a late principal payment once you start repayment.

Before completing an application, make sure you know:

- The interest rate and how it is calculated

- The amount of application or origination fees (upfront fees or repayment fees)

- When payments are required (interest and principal)

- If a co-signer is required

Choosing a Lender

FASTChoiceFASTChoice is a free tool that provides information about the common lenders that Ridgewater students have utilized. Students and their co-signers will find information about the range of interest rates offered, available borrower benefits, and other relevant information for each lender listed. Each lender will have an “apply” button that will take users directly to the application on the lender’s website. You are free to choose any lender, including those not presented.

SouthPoint Financial’s MarketplaceAs you begin to look toward attending college, private education loans may be available to you through a variety of lenders and banks to help cover the gap between the cost of attending college and the amount of other funding sources, including financial aid. To assist in your search, we invite you to use SouthPoint Financial Credit Union’s search tool!

With SouthPoint Financial’s platform, you can search and compare real, personalized private student loans offered from nation-wide lenders through a simple, three-minute form.

SouthPoint Financial provides a suite of tools that make loan comparison easy, digestible, and visual.

Resources

- PrivateStudentLoans.com

- FinAid: Private Student Loans

- U.S. Department of Education: Federal Student Aid

- Learn more about the differences between federal and private student loans.

Current Interest Rates